A happy retirement requires diligence and consistency in several categories. If you’ve read either of my books, You Can Retire Sooner Than You Think or What the Happiest Retirees Know, you know how well-rounded the happiest retirees are.

While I take great pains to point out that a happy retirement is about more than just finances, there’s no getting around that wealth is one of the most crucial elements. If you run out of money, it’s tough to pursue your other endeavors . . . or eat.

So today, let’s focus on ways you can preserve your money in your retirement. In my opinion, you should have a savings target, know your risk limits, and create an intelligent mix of investments. These are the essence to help you have some golden years of post-career living.

Let’s take each component and dig deeper.

Targeting Your Savings Goal

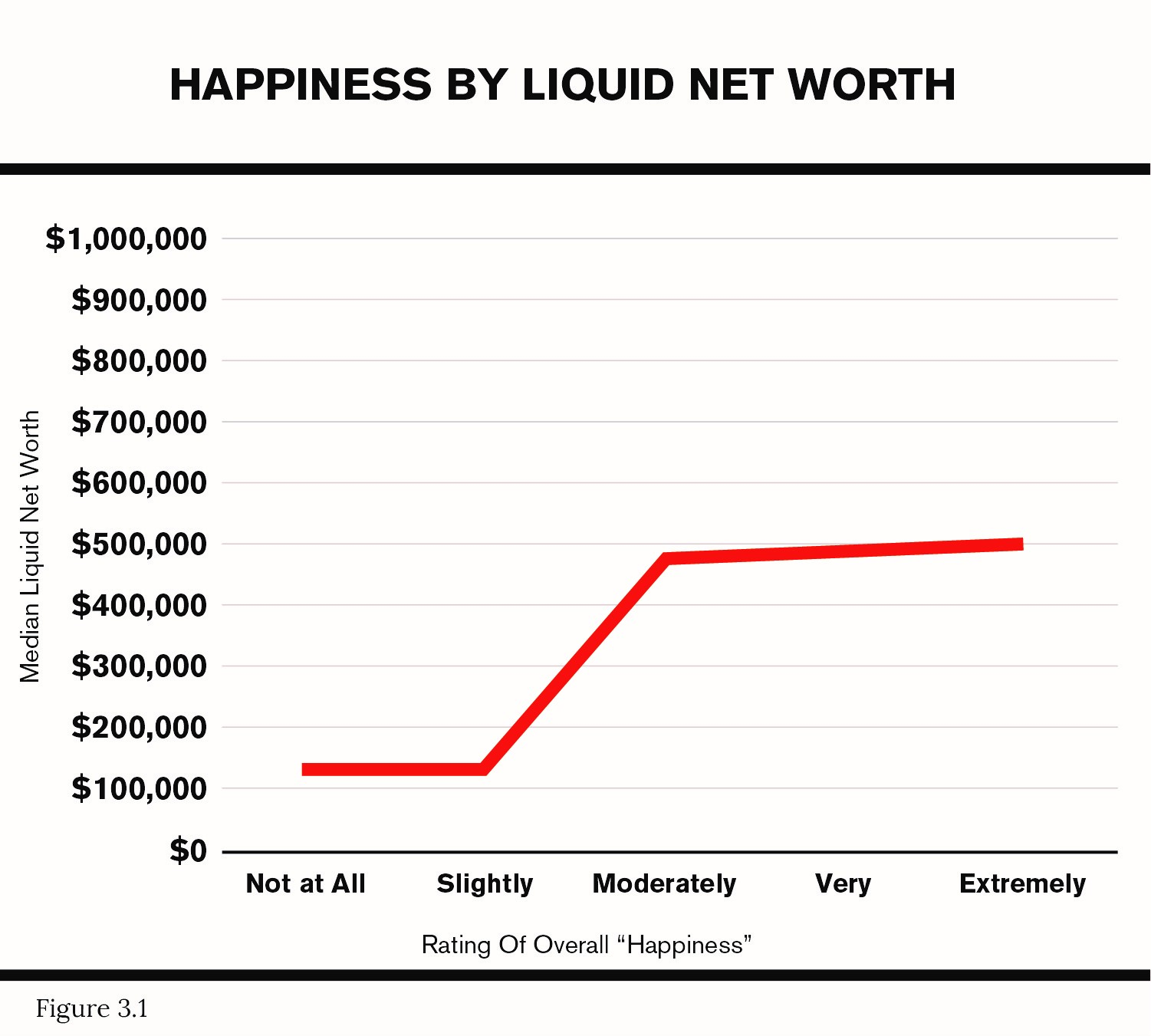

Let’s do away with some common myths — many happy retirees are not millionaires. The key number I’ve found for couples is half that.

Wes Moss Survey of Retirees

My decades of studies show that happy retirees have at least $500,000 in liquid retirement savings. As a reminder, liquid retirement savings are funds that you can access easily. Some examples are stocks, bonds, mutual funds, and cash. Work hard and save but don’t keep grinding just because Suze Orman says so. Suze Orman once claimed folks needed at least $5 million to retire. There’s a sensible way to do this that doesn’t require you to live a pauper’s lifestyle and die in your cubicle.

You should know how much money your retirement will require from your investments. It all starts with a budget and taking into account your projected expenses. Be sure to include your “fun money,” as this is the stuff that makes for happy retirements.

I use the $1,000-Bucks-A-Month Rule to shore up the difference. It can be a simple guide: for every $1,000 you need to be added to your budget from your retirement accounts each month, you’ll need $240,000 in your nest egg. The rule assumes a 5 percent withdrawal rate.

It’s important to note that this rule is a tool to help you visualize how much you’ll need; it’s not black and white.

Taking a closer look, let’s see how $240,000 in the bank equals $1,000 a month:

$240,000 x 5 percent (withdrawal rate) = $12,000

$12,000 divided by 12 months = $1,000 a month

The 5 percent withdrawal works well in years when the market and interest rates are in a typical historical range. I’m sure you’ve noticed that right now, interest rates keep going up. In such times, you must be willing to adjust your withdrawal rate. Market forces may work against you in any given year. There’s no magic wand, so you may need to take less when the situation calls for it. Conversely, you can potentially take out more when the market is flush. Like much of life, take the good with the bad and trust in the eventual restoration of balance.

If you’re unsure what your savings goal is, I recommend sitting down and creating that budget we discussed earlier. It’s best to start tracking when you’re ten years away from retirement. Not only will it give you a clear picture of your financial need from your investments, but it will also allow you to make some tweaks if necessary before you call it a career. On a recent episode of my Retire Sooner podcast, I interviewed Joe Saul-Sehy and Emily Guy Birken about their new book, Stacked: Your Super-Serious Guide to Modern Money Management. It has a terrific chapter about the difference between budgeting and tracking. One looks forward, the other backward, but both are vital to assuring your financial stability in retirement.

Risk Tolerance

There will be intermittent turbulence in the stock market. That is an undeniable truth. With this in mind, how much market volatility can you handle? Knowing where you fall on the risk tolerance spectrum is dynamic information for investors.

Here’s how I visualize the spectrum: on one end, having all your assets secured in a certificate of deposit (CD) is a 1. On the other hand, being wholly invested in small-cap and emerging market stocks is a 10.

If you’re a 1, we’ve got some wealth creation coaching to do because you most likely won’t earn enough money playing it that safe. If you’re a 10, you either have an iron stomach for market swings, you’ve mastered the art of meditation, you’re a hedge fund manager, or you aren’t being 100 percent honest with yourself. Very, very few people are a 10. Most people I work with fall right in the middle at a 5.

The critical thing to remember about assessing your risk tolerance is that time in the market typically beats timing the market. Participation is generally more important than perfection. Identify your particular comfort level with market swings so you’re not tempted to jump in and out because of fear of loss or fear of missing out. A giant portion of market recoveries happens quickly and unpredictably, and you want to be in the game when they occur.

A helpful rule of thumb on this topic is the 15/50 Stock Rule — if you believe you have fifteen years left on this planet, your portfolio should consist of at least 50 percent stocks, with the remaining balance in bonds and cash.

This rule aims to create a consistent risk/reward balance while leaving you able to stay the course and SWAN — Sleep Well At Night. Your stock allocation can be made up of either dividend-payers or growth stocks. Just keep an eye on your portfolio and reallocate as necessary to prevent stocks from creeping beyond the 50 percent mark.

The Bucket System

I love discussing dividend-paying stocks because I’m a tremendous fan of income investing. In my eyes, there’s no better way to enhance your portfolio than reinvesting dividends that you earn from owning dividend-paying equities. It’s a way to compound your investment accounts’ overall growth.

I’ve found a way to explain income investing using the Bucket System analogy. Think of it as having four buckets: Cash, Income, Growth, and Alternative. Each is distinct but equally important, though they probably won’t be allocated uniformly.

When I talk about the annual yield below, I’m referring to the income (dividends, interest, and distributions) from the group of investments in that bucket. Of course, price fluctuations of the underlying assets in the bucket could strongly influence your total return.

The Cash Bucket is designed to be your emergency fund, the money that lets you SWAN. This is usually primarily in savings, and you should expect the yield from your cash bucket to hover around zero. If you would like to put some of that cash into a money market account, you could yield about 2 to 3 percent given the recent rise in interest rates.

The Income Bucket consists of your investments in different types of bonds. Think Treasury, municipal, corporate, international, floating rate, and high-yield. The bonds you’re invested in can range from less risk (Treasury) to more risk (high-yield), with returns that will vary in kind. Keeping a blend of bonds is prudent to maximize your yield while maintaining a degree of protection of your principal. The annual yield depending on your mix should fall in the 4 to 7 percent range.

The Growth Bucket, in my opinion, is the meat-and-potatoes bucket with yields typically in the 2 percent to 5 percent range. Typically, most of your Growth Bucket stocks should pay a dividend. Telecommunications, consumer staples, utilities, and healthcare regularly offer this option. However, some stocks in this bucket may not pay dividends, like tech companies. This combination of growth and income can be a good diversification strategy!

The Alternative Bucket has assets that aren’t traditional stocks or bonds. Examples include master limited partnerships (MLPs), real estate investment trusts (REITs), preferred stocks, and closed-end funds. This bucket comes with higher levels of risk and has the potential to provide higher current income than stocks and bonds. I consider this your overall portfolio yield-enhancer, as you could see yields ranging from 4 percent to 8 percent.

And that’s it! Easy, right? Just be mindful to keep an eye on your buckets’ performances. As life progresses, your financial goals may change. That’s okay as long as you make the necessary adjustments.

So, are you on the right track for a financially stable retirement, or are you worried about running out of money? Consider the elements above and give yourself a grade for each. With some tweaking and attention, anyone can build a happy retirement. It just takes planning and implementing your strategy. Once that’s done, you get to move on to the fun part — enjoying the fruits of your labor in the ways that bring you the most happiness.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.