Extensive research and tireless surveys of thousands of happy retirees have convinced me that several different tiers of preparation are required to find happiness in retirement. I’ve taken all this research and narrowed it down to ten core categories and thirty habits of the Happiest Retirees on the Block (HROBs).

Nurturing healthy habits about curiosity, family, love, and more is essential. Of course, happiness manifests with devoting time and effort to a well-rounded retirement. But financial habits are the foundation for peace, security, and freedom, and there’s no point in pretending otherwise. Life isn’t all about money, but without money, it’s tough to have a life.

Once you retire, you will need enough funds to cover your living expenses in retirement.

I cover this in my latest book, What the Happiest Retirees Know: 10 Habits for a Healthy, Secure, and Joyful Life. I teach money habits that are relevant for a happy retirement.

Let’s examine what I consider the five most important money habits.

Habit #1: Have a Minimum of $500,000 in Liquid Retirement Savings

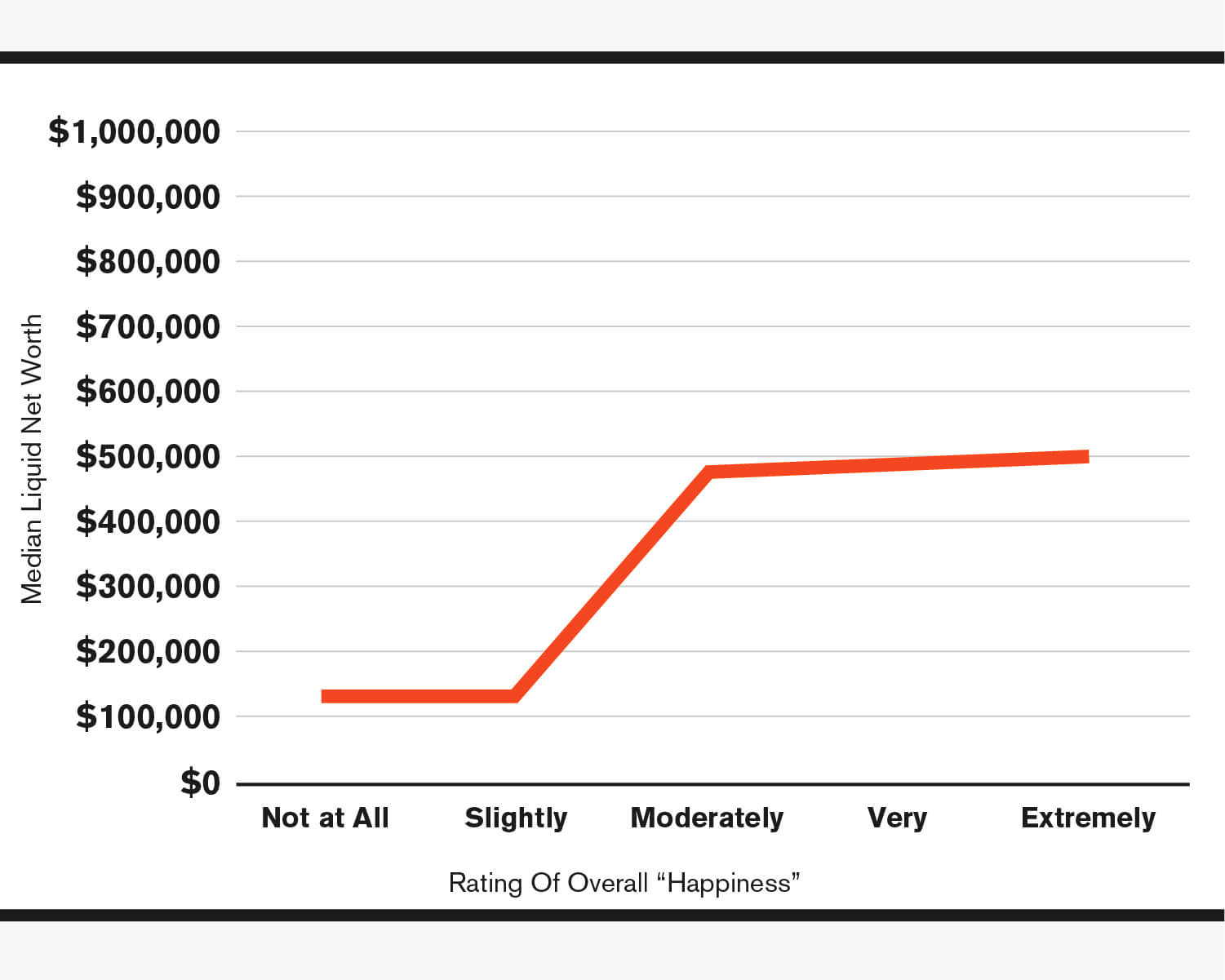

$500,000 is the key number when it comes to a happy retirement based upon my research. As a reminder, liquid retirement savings are funds you can easily access, such as stocks, bonds, mutual funds, and cash. Of course, there are happy retirees with less than $500,000, but we see significant improvements in happiness levels from $0 to $500,000. Having more is fine, but due to what I call the Plateau Effect, happiness tends to level off with increased accumulation. Sufficient money raises happiness. Based upon my research of happy retirees, excess liquid retirement savings over $500,000 has less of an impact on being a happy retiree.

Wes Moss’ Survey of Retirees from ‘What The Happiest Retirees Know’

Economic needs vary. If $500,000 sounds high, don’t panic. It takes a lot of time and hard work to acquire that wealth. However, it can be more attainable than the figures demanded by some of the other retirement “gurus” out there. For example, bestselling author, Suze Orman once claimed folks needed at least $5 million to retire.

Habit #2: Get the Mortgage Paid or Have Payoff Within Sight

Retirees within five years of mortgage payoff are four times more likely to be HROBs! As the years to pay off the mortgage tick down, happiness levels go up!

This revelation surprised me but surveying over 1,500 families left very little doubt. We can explain it in many ways, but mortgage payments are typically our most significant, scariest expenditures. A mortgage represents the basic human need for shelter. Without shelter, we’re thrown to the wolves. In my neighborhood, it’s more like being thrown to the golden retrievers, but you get the point.

Despite its exigency, the mortgage can be an unsatisfying, repetitive payment. It’s not money for travel, school, or any memorable enjoyment. Instead, receiving that bill is the financial equivalent of your mom telling you to clean your room . . . with interest.

Conversely, having no mortgage is a massive relief on so many levels. No one can take your home from you. Suddenly, that monthly amount can go toward fun, family, and living life to the fullest.

The opposing argument is that you can make more money if you keep your mortgage and invest your savings. This argument relies on the premise that the interest paid on the mortgage will equal less than the interest and returns earned in the market — a point of view worth discussing when mortgage rates are sub-3 percent but more dubious at the current 7 percent rate!

How should you decide if you can afford to pay off the mortgage? I like using the One-Third Rule as a guide — if you can pay off the mortgage using no more than one-third of your non-retirement savings, consider doing so. Don’t use your 401(k), IRA, or other workplace retirement savings for this purpose. So, as an example, if you have $150,000 in non-retirement savings and only owe $40,000 on the mortgage, you might want to consider paying it off.

I’ve learned from the happiest retirees that peace and serenity come with owning your home free and clear. It also dramatically lowers your monthly retirement living expenses, taking the pressure off your nest egg and other sources of monthly income. For all these reasons, I think the pros of paying off the mortgage outweigh the cons.

Habit #3: Have Multiple Streams of Income

My research shows that more income streams lead to higher levels of happiness in retirement.

Imagine you were going to receive $10,000 per month for life. Would you want one $10,000 check in the mailbox or ten different $1,000 checks? I’ll answer. You would want ten checks so that not all your eggs were in one basket. Heaven forbid that basket broke. You’d be in big trouble.

Multiple income streams can come from all different sources: Social Security, rental property, pensions, income from your IRA/401k/brokerage account, etc. Having multiple income streams also allows for tax planning strategies that make sense for you and your family. Lastly, more income diversification can be better from a psychological perspective and gives you increased control to manage your taxable income during retirement.

So, while planning for retirement, consider all possible retirement income streams!

Habit #4: Be a Tomorrow Investor

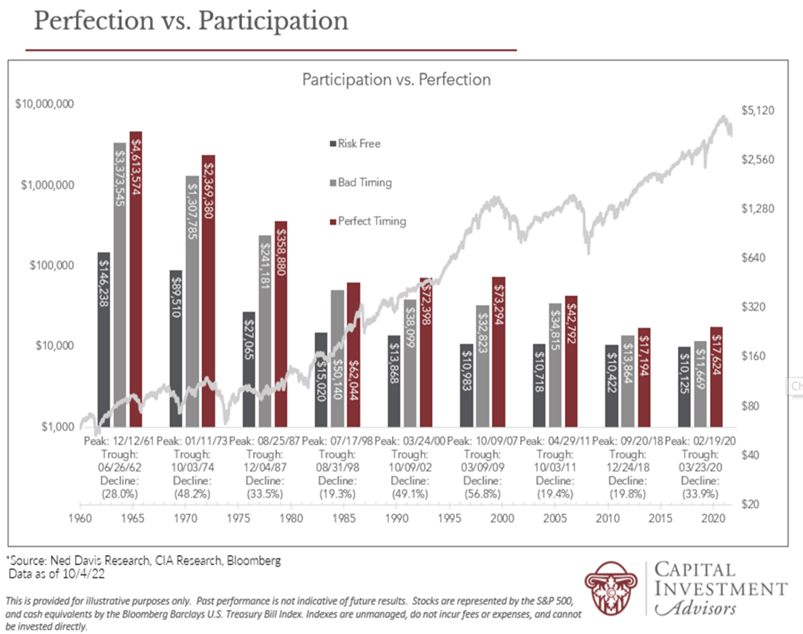

Happy Retirees understand that investing is more about participation, not perfection. If we wait until the perfect time to invest, we’ll never do it. Even bad market timing is generally better than being out of the market. As investors, that feels counterintuitive. But the numbers suggest otherwise.

The data points illustrate how an investment of $10,000 in the S&P 500 can grow over a particular period. Each is relevant in that those specific years were on the precipice of a stock market correction. It takes time to recover from any downturn. The data show what you would have as of Q3 of 2022 (September 30, 2022) had you chosen to invest the $10,000 during each of the following situations: Perfect market timing (when the market was at the bottom of the cycle), the worst market timing (right at the market top), and simply holding money in Treasury Bills (T-Bills), which essentially equates to sitting on cash.

Here’s how the numbers compare for selected periods of sixty-plus years, twenty years, ten years, and three years.

Long, Long Run — Sixty Years — Investing in the Early 1960s

This example is anything but hyperbolic but reiterates that long-term investing can be effective. Looking at 1961, let’s see what $10,000 invested at the absolute bottom of the 1960s bear market is worth (perfect timing) vs. investing at the 1961 peak (worst possible timing) vs. leaving the $10,000 in T-Bills to avoid all risk.

Perfect timing: $10,000 became $4.6 million. Worst timing: $10,000 turned into $3.4 million. T-Bills: $10,000 grew to about $146,000.

So, the worst stock market timing was worth twenty-three times the amount from investing in T-bills! I realize that’s a lot of time for growth, so let’s try our luck with twenty years.

Long-ish Run — Investing in the 2000-2002 Time Frame — About Twenty Years

Perfect Timing: $10,000 invested at the worst possible time, the market peak in March of 2000, vs. at the absolute bottom in October 2002. $10,000 today with perfect timing worked nicely. $10,000 became $72,000. Worst Timing: $10,000 became $38,000 — still almost four times your money. T-Bills: $10,000 is now less than $14,000. Again, even the worst stock market timing would have netted you nearly two and a half times what T-bills would have done.

Intermediate Run — 2011 — Roughly Ten years

2011 was another year with a bear market decline (-19.4 percent). Perfect Timing: Investing $10,000 in 2011 at the trough left the money worth about $43,000. Worst Timing: Investing at the 2011 peak, your $10,000 would now be worth about $35,000. That’s still more than three times your investment. T-Bills: Your $10,000 would be worth about $11,000. Even the worst possible timing from 2011 leaves you with more than three times that amount.

Short Run — the Pandemic Crash in 2020 — About Three Years

Imagine you were about to invest $10,000 before the pandemic hit, but you waited and managed to bullseye the March 2020 bottom.

Perfect Timing: Your $10,000 would be worth about $17,500. Worst Timing: Investing right before the pandemic crash in Feb of 2020, your $10,000 would be worth $11,500. T-Bills: Because interest rates were so low, your investment would be only a few dollars north of $10,000. So, even the worst possible stock market timing beat T-bills by over 10 percent.

The Upshot

HROBs are tomorrow investors. They understand this market history, which helps them focus on what matters: participation, not perfection. In every scenario outlined above, investing at the “worst” time bested holding cash.

The same culprit is almost always responsible for bailing on the market: fear and uncertainty. And I get it, but this is one of those times when it helps to be vigilant about our focus on the future because we know that in general, happy retirees understand participation over perfection.

Habit #5: Spend Wisely Using the 4 Percent Plus Rule

This habit helps you budget your way clear of the anxiety that comes from running out of money, no matter where inflation levels happen to sit.

In 1994, William Bengen, a Massachusetts Institution of Technology aeronautics and astronautics graduate turned financial planner, calculated stock returns and retirement scenarios for the previous seventy-five years. He found that retirees who drew down 4 percent of their portfolio in the first year of retirement, adjusting every year for inflation, would likely see their money outlive them. This finding assumed the portfolio would have a 50-75 percent allocation to stocks.

Based on his calculations, nest eggs last fifty years 80 percent of the time. In the worst-case scenario, the money still lasted thirty-five years. Thus, it’s no wonder that the 4 Percent Rule quickly became a road map to help people maximize spending while focusing on not depleting funds. In other words, this was the way to go for broke without going broke.

My team and I tested this rule of thumb in 2014 and 2021 and found that we believe it still works. At 4 percent, the money lasted for forty years, 92.7 percent of the time. 82.9 percent of the time, it lasted forty-five years. Even at the high end of the projection, fifty years, there’s a 70.7 percent chance your savings will remain sufficient. Once we veer into the more realistic retirement lengths of thirty or thirty-five years, you’re edging closer to a 100 percent chance of you and your savings living happily ever after.

As a bonus, Bengen (and our team separately) tested the theory at 4.5 percent, effectively a 12.5 percent raise for the retiree. Moreover, he found that by adding small-cap stocks, the money had over a 90% chance of lasting 30 years.

My twenty years of helping people plan for retirement have shown me that using a dynamic approach to your nest egg is the key. Anywhere from 4 percent to 5 percent should be sustainable if you are willing to make adjustments as needed. Sometimes you withdraw a little more, and sometimes you tighten the belt. Dipping into your nest egg should be flexible, but it needn’t be miserly.

Bottom Line

Don’t let anyone tell you can’t be a happy retiree. One of the best parts of my job is seeing so many folks absolutely loving their second-act lives. Of course, it takes effort and planning, but if you emulate the financial habits of the HROBs, you could be well on your way!

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,