If 2022 felt painful, it’s because it was. There is no use sugarcoating the profound challenges investors endured.

A traditional balanced portfolio with 60 percent in stocks and 40 percent in bonds had its worst performance since 1937. Not even the 2008 global financial crisis or the inflationary bear market of 1973-1974 matched its agony. Technology stocks ended the year down almost -30 percent, while consumer discretionary stocks as a group (Amazon, Tesla, Nike, etc. as an example) were down practically -40 percent. As of this writing, the S&P 500 still hovers near bear market territory. Inflation is alive and likely to persist for the foreseeable future. Combine that with a war in Ukraine, a cryptocurrency collapse, and a Federal Reserve committed to raising interest rates to the highest level in nearly two decades, and you have the potential for another problematic year.

However, it’s not all bad news. Some significant silver linings were sprinkled amongst 2022’s outrageous misfortune.

1. Dividend stocks held up relatively well.

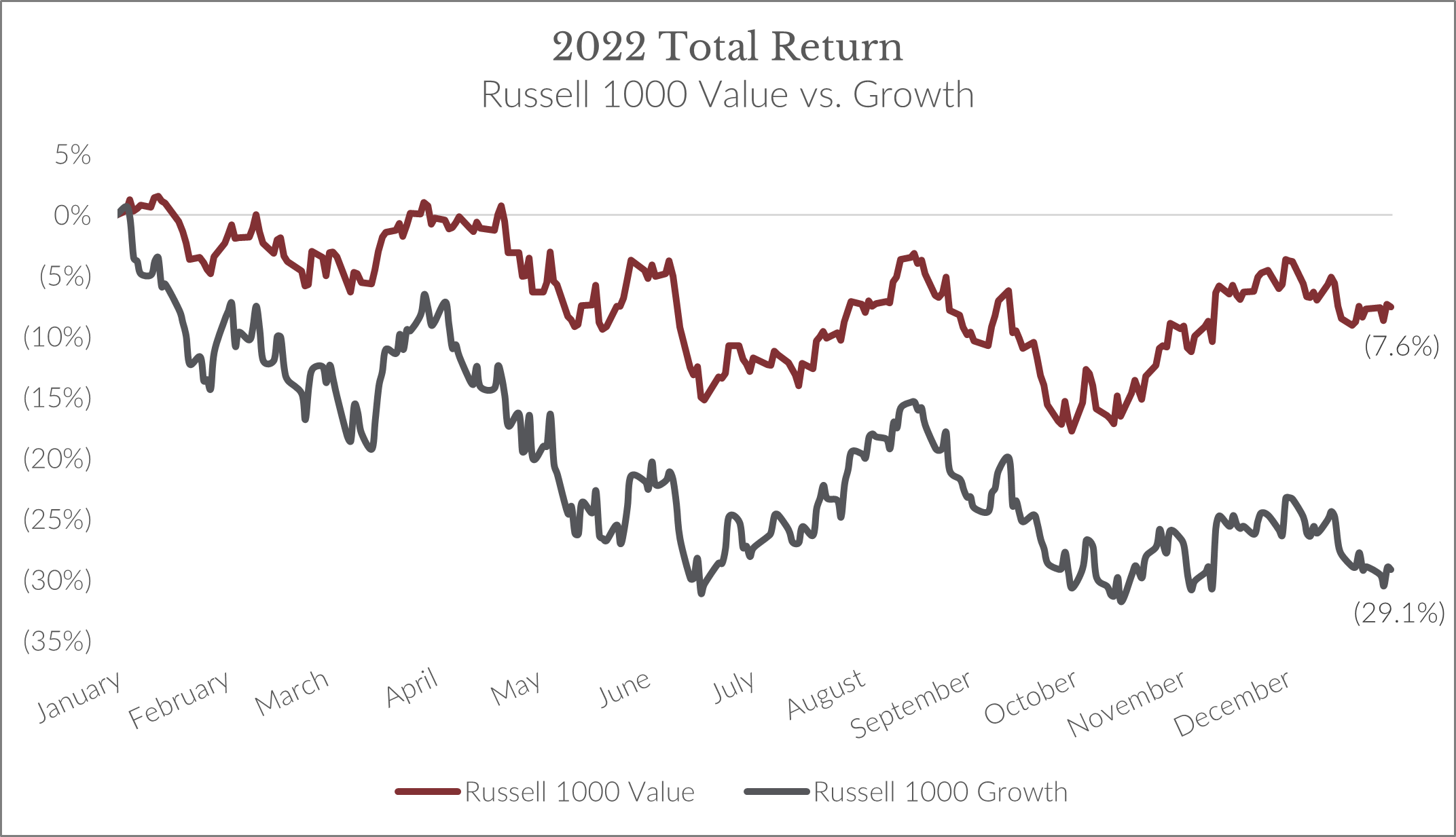

Despite the deluge of scary market headlines and sizable negative returns from irresponsible investing styles, income-oriented investors held up well on a relative basis. It certainly wasn’t a year for celebration, but investing with an eye toward stock dividends proved a durable strategy in a time of stress. For example, the Russell 1000 Value Index which measures dividend/value-oriented stocks was down 8 percent, while the Russell 1000 Growth Index which measures growth-oriented stocks finished down 29%. See the chart below.

Source: Capital Investment Advisors; Bloomberg data

2. Bond yields rose to attractive levels.

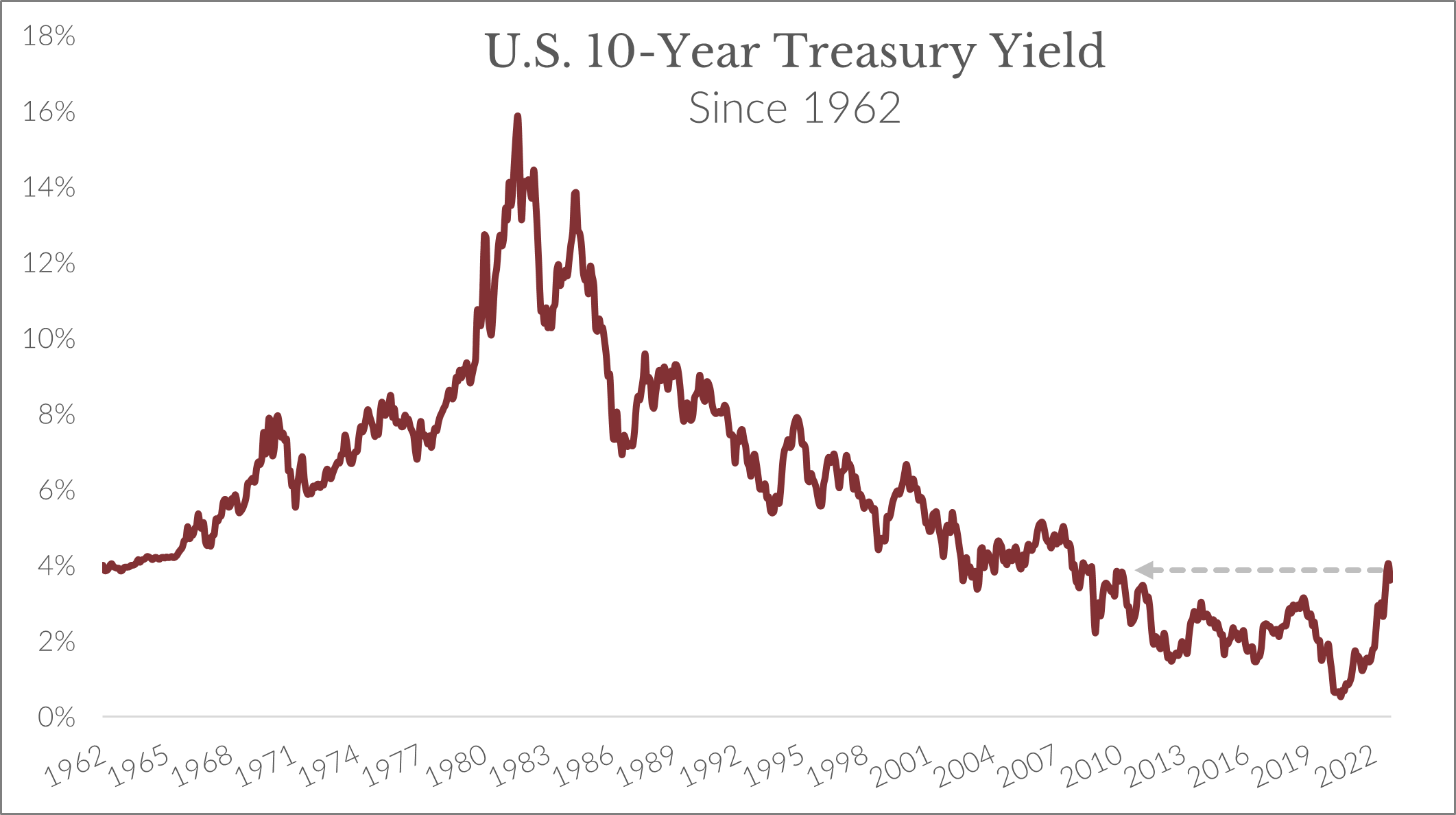

The 10-year treasury currently yields nearly 4 percent, its highest level since Fall 2008 and well above the 0.5 percent COVID nadir. This rate means many investment-grade bonds are now paying 4 to 5 percent interest rates. To say this is welcome news for income-oriented investors is an understatement.

3. Many market excesses have been wrung out of the system.

Many pockets of excess, which began bubbling up in the near-zero interest rate environment, have finally burst — think cryptocurrencies, pandemic “stay-at-home stocks” like Zoom and Peloton, and tech stocks with sky-high valuations despite little-to-no earnings. With that era in the rearview mirror, the market should be placing more attention on well established companies with actual earnings.

Those are some shiny silver linings, but looking ahead to 2023, will the polish continue to sparkle? I hope it will.

Undoubtedly, inflation will remain a key theme in the year ahead. While I think it’s peaked, and price increases should continue to slow, inflation could persist to some degree. Unfortunately, the Fed can only do so much to put on the brakes on inflation without causing too many other problems. Their primary tool to combat inflation is raising interest rates, but there’s little they can do to solve a world economy marching toward less globalization after a decade of under-investment in energy resources.

Less globalization, onshoring to the U.S., and dampened oil and natural gas supply leads me to believe that inflation should linger, keeping prices higher than we all might like. This isn’t to say a 5 percent plus period of inflation awaits, but there are signs it should remain higher than the 1 to 2 percent range to which we were accustomed for decades.

With this perspective in mind, here are two central investment themes.

1. Dividend stocks can help combat higher inflation.

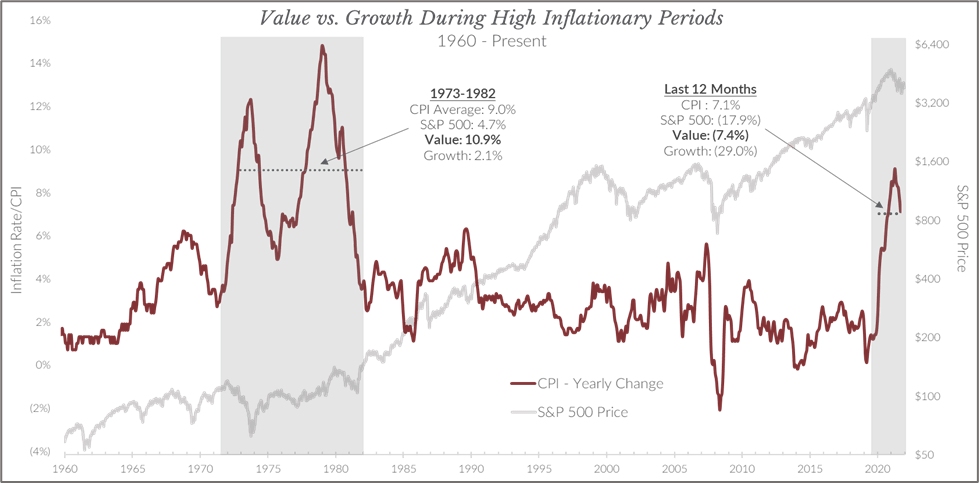

If inflation remains elevated, the data show us that value stocks (which tend to pay higher dividends) have historically weathered the storm better than growth-oriented stocks. As inflation eats away at the value of a dollar, investors tend to value cash in their hands sooner rather than later. And what helps to solve that problem are companies that pay dividends today (value stocks) rather than promise to pay in the future (growth stocks). This trend gained steam in 2022, and I wouldn’t be surprised if it were the start of a multi-year dividend renaissance.

The chart below is a beneficial illustration of what to understand as we move into 2023. Keep in mind that the last period of sustained inflation in the 1970s and the last twelve months saw value stocks significantly outperform growth stocks. See the figures below.

Source: Capital Investment Advisors; Bloomberg data

2. Bond yields are now at fifteen-year highs.

Many high-quality bonds are now paying 4 to 5 percent, among the highest rates in nearly fifteen years. While the road to get here has been rough, a much better rate of return on bonds is a happy consequence. Of course, prudence is still required, but there’s nothing wrong with toasting to the fact that high-quality bonds are finally lucrative.

Source: Capital Investment Advisors; Bloomberg data

2022 was a historically tricky year, but sensible decisions about income investing with more value-oriented stocks did provide some cushion and safety in a hairy market with very few places to hide. While we don’t know precisely what 2023 will have in store, a continued focus on high-quality stocks and bonds that provide consistent and growing income will remain as important as ever. Remember the words of vaunted investor Peter Lynch: “The real key to making money in stocks is not to get scared out of them.”

The U.S. economy isn’t without flaws, but time and time again, it’s shown robust resilience. Let history guide you toward peace and prosperity.

If you’re ready to plan your retirement, schedule your free consultation today.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. The mention of any company is provided to you for informational purposes and as an example only and is not to be considered investment advice or recommendation or an endorsement of any company. The reader should not assume that an investment in the securities identified was or will be profitable. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information is strictly an opinion, and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,