I love when clients, investors, and listeners of the Money Matters radio show and the Retire Sooner podcast reach out with questions for Wes and our team because I often get to jump into the mix and help. Some questions are straightforward, and others turn me into a research librarian, but many are thoughtful and useful reminders of what it takes to plan a happy retirement.

A few weeks ago, “Darrell from Dacula” wanted to know five critical things related to stocks and finances that he should pass along to his adult children. Such a thoughtful question. If Darrell didn’t get a Father’s Day card, there’s no justice in this world.

I initially answered his question quickly, as I’ve brainstormed for the future of my two boys and had some ideas already chambered. I was about to click send on the email when it dawned on me that I’m surrounded by a team of both mentors and protégés. These folks are the nuts and bolts of the operation. They get up every morning with the goal of helping Americans retire sooner and happier.

So I got up from my desk and walked down the hallowed halls of Capital Investment Advisors Atlanta headquarters. I came across our investment advisors, operations team members, and analysts.

After a shock and awe campaign of spontaneous, rapid-fire questions lobbed at anyone who crossed my path, I walked away with a haphazard stack of chicken-scratched post-it notes full of plucky, clever, and responsible tips. In hindsight, a full-sized notebook would’ve been a good investment.

And I didn’t stop there. We’ve got offices in Phoenix, Denver, and Tampa and all of them were fair game. I even reached out to a few well-respected competitors, to get a broad set of feedback from practitioners in the industry.

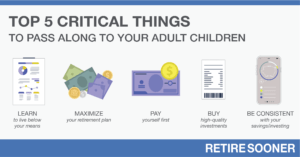

We received a lot of good answers and feedback, but here are our top five critical financials tips to pass along to your adult children.

Answers

- Learn to live below your means. Pay taxes and bills, then save the extra and invest for the future.

This was by far and away the most frequent response. What may have been common practice for the children of the Great Depression has proved very challenging for the generations to follow.

Keeping up with the Joneses has only gotten more competitive with the emergence of social media. Big new houses, fancy cars, luxurious vacations, and a million other life choices can really drain our money supply. Being constantly bombarded by the temptations of instant gratification can cause even the savviest savers to trip and fall.

Living below your means, setting aside emergency cash, medium-term, and long-term retirement savings now eventually pays off and helps you become a happy retiree.

- Maximize your employer-sponsored retirement plan, and/or any other retirement plans you have access to. Take advantage of employer matching and tax-deferred growth.

Employer matching inside of employer-sponsored retirement plans is basically free money. Don’t miss out!

When these dollars grow tax-deferred, they have more exposure to the potential power of compounding growth.

- Pay yourself first.

In my opinion, you should save at least 20% of your pretax income for retirement investments. One of my favorite rules of thumb is the 30/20/50 approach. Save 30 percent for taxes, 20 percent for (mostly retirement) savings, and 50 percent for living life and having fun.

You don’t have to go overboard sticking to exact figures, but this is a good general guide. For example, saving for a home purchase or education planning may mean a little more savings for those specific goals are taken from the life/fun bucket.

Automation is an effective way to ensure you pay yourself first. We’re all busy people, so why not remove the room for error? Review your budget, figure out how much you can start saving, and then create automatic and recurring deposits from your paycheck or bank account to go into your various savings and investment accounts.

- Buy high-quality investments (with some diversification) as soon as you can and try not to look at them often.

Remember that compounding growth is a strong force in the universe, according to a quote that gets attributed to Albert Einstein.

You could start with broadly diversified mutual funds or ETFs, which are typical investment options in a retirement plan, then build with more focused individual investments over time.

High-quality investments include companies with fairly balanced risk/return profiles and conservative corporate balance sheets. This means they don’t carry much debt, are well established, and can be reasonably expected to remain in business for years to come.

Having worked with self-directed investors for many years, I’ve seen so many of them fall into the trap of buying the hottest stock du jour and obsessively checking prices every day. This is a sure-fire way to watch your anxiety spike long before your stocks do and often leads to folks giving up and selling at a loss.

In contrast, those who set up a recurring investment process and then get on with the important task of living a full life are typically more relaxed and happier both before and after retirement.

This isn’t to say that aggressive investments can’t be beneficial to a portfolio, it’s just important to know they can have dramatic downturns at times and require more time to recover in a downturn. As in so many facets of life, moderation is key.

- Be consistent with your savings/investing to take the emotion out of it.

While the market is known to have significant and sometimes scary drops over periods, historical trends show that the market will at some point recover and continue to rise higher in retrospect. Investing is a long-term strategy of staying the course and continuing to invest over longer periods.

Dollar-Cost Averaging is the process of repeatedly investing at regular intervals. This typically means the same dollar amount, in the same investment, over a period of time. It’s mostly an equivalent process to 401(k) or 403(b) retirement plans with a few minor variations. This can also be done independently in a regular, non-retirement account, as long as you can make room in your budget.

Conclusion

All of us parents want to give our kids the tools they need to be happy, safe, and secure. I’ve offered five tips to help make that dream a reality in terms of financial stability.

If you want to discuss it more in-depth, you might want to find a trusted financial advisor, CPA, or both. Our team at Capital Investment Advisors is always ready and willing to get the ball rolling.

In the meantime, remember to love your friends and family while you can. As soon as you finish reading this, give them a call and let them know how much you care. Be like Darrell from Dacula—thoughtful and prepared.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.